CBRE: 88% of the investment deals in office segment in Romania involve green office

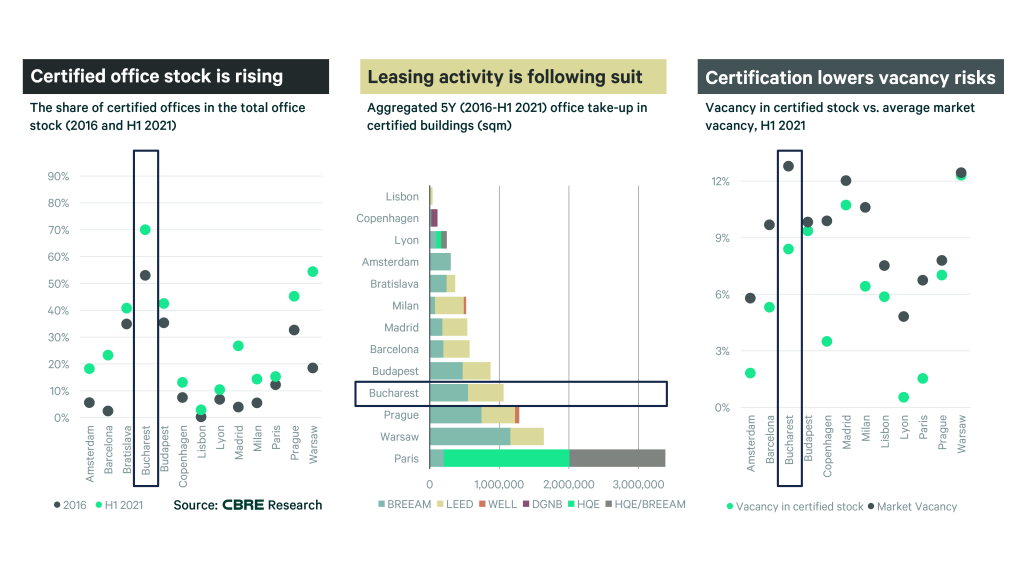

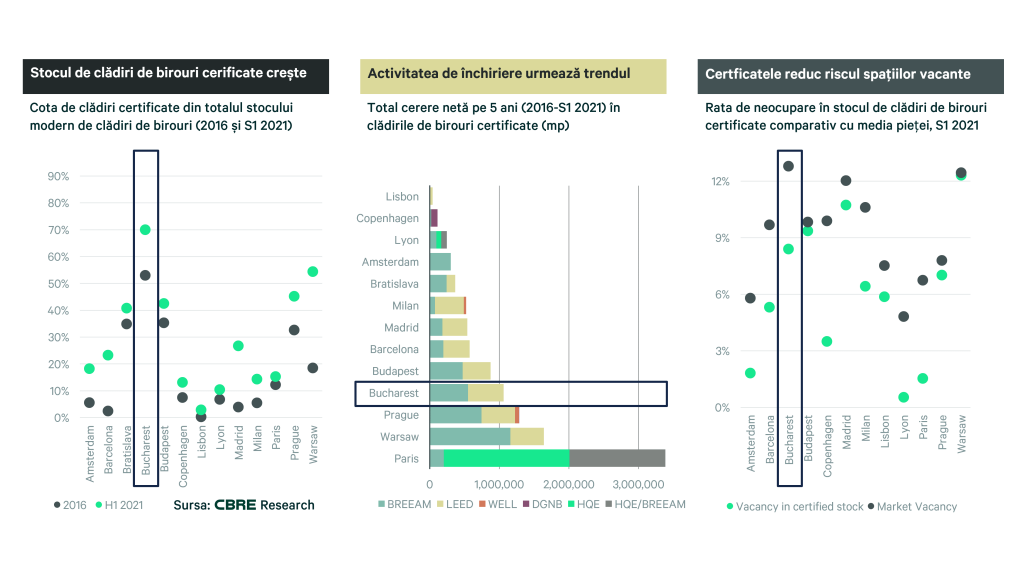

“We see a clear trend in Europe of tenants being very interested and willing to pay a higher rent for environmentally friendly premises. This can range from just 10% to almost 30% in Copenhagen, Barcelona or Amsterdam. In Romania, the premium rent is squarely in the middle, at 16.5%, but we have seen cases with even higher figures. Tenants have relocated from older buildings to green buildings in the same area of Bucharest and paid over 25% for a new premium office, from €11/sqm to €14.5 /sqm net effective. This is reflective of a sustainability driven relocation trend. We have seen several stable tenants that make relocation decisions driven by their new corporate sustainability goals. We are talking about a spread now, but since ESG criteria are becoming a must for tenants, it could be that being green means having occupied buildings,” Luiza Moraru, Head of Property Management CEE at CBRE, said at CEDER 2022 real-estate conference that took place today.

According to CBRE European Investors Intentions Survey (February 2022), 70% of all respondents have already adopted ESG criteria and the majority of investors see upgrades as a key to ESG implementation. Also, from 2023 onwards, under EU legislation, some 50,000 companies with more than 250 employees or net revenues of €40 million must submit CSRD reports.

“The attention on sustainability principles, in particular energy efficiency, has increased rapidly in the commercial property sector. There is a widespread perception that, although development of sustainable buildings generally incurs an additional incremental cost, it should also generate positive value benefits like lower voids, faster leasing, covenant strength, more liquidity, better leasing terms”, Joanna Sinkiewicz, Head of Industrial & Logistics for Central and Eastern Europe at CBRE, added at the same event.

According to EU Taxonomy, among the sustainable activities in real-estate are renovation of existing buildings, the retrofitting being considered the best solution for real-estate. The available data show that 85% of the European buildings were built before 2001, and 85%-95% will be standing by 2050. Investment in retrofit could generate to the European Union up to 175 billion euro per year.

In Romania, 69% of modern retail stock was delivered before 2013. Of the total stock of 4.03 million sqm, only 0.53 million sqm has been refurbished in the last 3 years, indicating that redevelopment projects will become the norm rather than new development. With redevelopment and energy efficient equipment, green features and green energy solutions become standard, in addition to the social and inclusiveness function that shopping centres already fulfil.

While during the pandemic, retail parks reported very good traffic and turnover, current trends show that the shopping experience is the most valued asset by customers. E-commerce and the omnichannel approach have become a normal way of doing business, leading to an accelerated development of the logistics and industrial sector. According to available data, Romania’s e-commerce sector will reach €7 billions in 2022, up 13% from 2021, and every €1 billion spent on e-commerce requires 100,000 sqm of new industrial space. 38% of Romania’s modern industrial stock was delivered before 2013, and 2.23 million sqm of industrial stock needs upgrading to meet ESG standards.

About CBRE CBRE, Inc. (NYSE: CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm, based on 2019 revenue. The company has more than 100,000 employees (excluding affiliates) and serves real estate investors and occupiers through approximately 530 offices (excluding affiliates) worldwide. In Romania, CBRE offers an extensive range of integrated services including transaction management and coordination, project management, design and build services, property management, investment management, valuation, property rental, strategic consulting, property sales, mortgage services and development services