Telekom Romania announces the financial results for Q4 2019: upward trend for consolidated revenues, profit, cash flow and FMC services

Telekom Romania group of companies announces the main performance indicators for the fourth quarter of 2019, ended on the 31st of December 2019, according to the data released today by OTE Group.

After a difficult 2018, the company is delighted to announce that 2019 was a year in which more customers decided to join Telekom and recorded improved performance following the transformation process started in 2017.

For the full year 2019 all major financial indicators – Revenue, EBITDA and adjusted Free Cash Flow (FCF) showed a year-on-year growth for the first time in four years. In 2019 the consolidated revenues of Telekom Romania increased by 5 per cent, to 980 mil. Euro. At the same time, adjusted EBITDA before IFRS16 increased by 5% to 144 mil. Euro, thus growing for four quarters in a row. Adjusted Free Cash Flow, corrected for one-off historical payments to OTE Group, also registered relevant growth of over 55 mil. Euro in 2019, becoming positive for the first time in three years.

Revenue growth was fueled mostly by the company’s core business. Fixed revenues increased by 11% to 479 mil. EUR in 2019, supported by strong growth in the ICT segment, exceeding 110%, as well as that of wholesale services with more than 20%. At the same time, broadband & TV services registered a slight growth in revenues of more than 2%. FMC revenues have grown y-o-y with approximately 30%. Additionally, the newly launched product Smart WIFI generated high demand.

In mobile revenues, Telekom had 4 consecutive quarters of growth in 2019 reflected in the overall yearly growth, significantly driven by large ICT transactions in Q4. On the cost side, compared to 2018, total OPEX (Operating Expenses) declined by more than 3% and shows a further improved run rate in Q4. This saving and the better cash flow are a direct effect of the company’s ongoing transformation program “Cash for Growth”, which has driven a significant number of initiatives to successful completion. As part of this transformation process, the number of full time employees went down by 21% y-o-y from 6,356 in 2018 to 5,029 in 2019, through automation, simplification and focus on customer-facing units.

“The 2019 results prove that our strategy of redefining our operational model to become a simplified and digital company and to liberate the internet is correct” said Miroslav Majoroš, CEO, Telekom Romania.

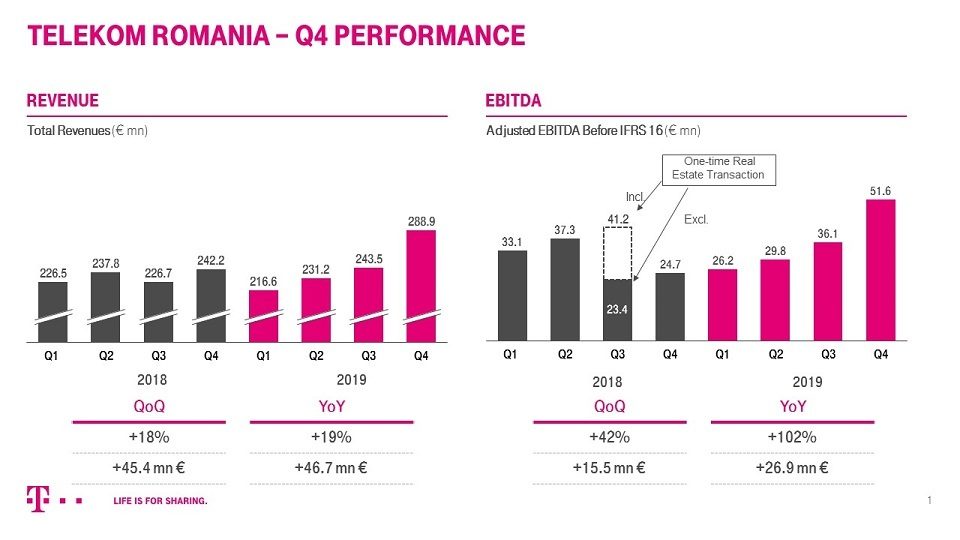

The promising results for the full year 2019 also reflect a good performance of the last quarter of the year. In Q4 2019 the group’s consolidated revenues continued the upward trend from the previous quarters, reaching 289 mil. EUR, a 19% increase against Q4 2018, heavily driven by major ICT related projects.

Adjusted EBITDA before IFRS 16 increased by 109% against Q4 2018, reaching 51.6 mil. euro in Q4 2019. This came as a result of improved top line and cost performance paired with a favourable comparison base

The strategically important FMC segment continued to grow through 2019, recording a 72% y-o-y increase in revenues in Q4 2019, now totalling over 846,000 users and extending Telekom’s market leadership in this segment. These results reflect the positive impact the company’s convergent offers have on the Romanian consumers and their appetite for complete fixed-mobile services.

Revenues from retail fixed services declined by 5% in Q4 2019 against Q4 2018, to 55.4 mil. EUR. This was driven by a declining customer base especially on the traditional fixed line voice and DTH business, which was only partially offset by an increase in Average Revenue per User (ARPU).

The TV services segment reached 1.3 mil. users in Q4 2019, an 8% decline – mainly on DTH – vs. Q4 2018, which was offset via diversified content packaging and an increase in ARPU, so that revenues stayed stable.

The number of broadband service subscribers had a slight decline compared to Q4 2018, reaching 1.1 million users. Simultaneously, broadband revenues in Q4 2019 recorded an 8% increase against Q4 2018, which was the result of the company’s push towards higher-value customers, resulting in an increase in ARPU.

Mobile services revenues further stabilized in Q4 2019 totalling 75 mil. EUR, with only a slight decrease of less than 1% over 2018, a result which supported the successful completion of a major ICT project. A positive trend can be seen on mobile data revenues, with a continued growth of 11% in Q4 2019 compared to Q4 2018.

The strategy of shifting pre-to-postpaid contracts continued in 2019, with the share of postpaid customers in the total mobile base of 4 mil. customers increasing by 38% by the end of Q4 2019. This was further supported by the launch of the Mobil Nelimitat product in July.

“We are satisfied with the 2019 performance. We recorded growth at the same time in the three major financial KPIs – Revenue, EBITDA and FCF, and this for the first time in four years. This makes us confident that we are on the right track. However, we are only half way there. We have stabilized the business and can see early signs of further recovery. However, we have to stay focused and disciplined in executing our strategy. The game is not over, we have to play the next rounds as well and they will be challenging. Still, our momentum is good, as our performance grew as well in Q4 2019, despite a competitive market environment” said Nicolas Mahler, Chief Financial Officer, Telekom Romania.

“The postpaid growth was driven by very good portability results, which placed us second among telecommunications operators. In 2019 we ported over 249,000 mobile numbers into our network. Surveys show that 70% of these customers are more satisfied now. 249.000 satisfied customers for whom we are very thankful and which had a positive impact on our 2019 results. Thank you and welcome to the Telekom family” continued Nicolas Mahler.

“Our approach to liberate the Internet via the most recent offerings of Mobil Nelimitat for residential and Freedom Mobile for business customers results in high demand, confirming once again that our approach meets the expectations of our customers.

The combined revenues from ICT services, which were slightly above 95 mil. EUR in 2019 prove that we have remained a leader on the IT&C integrated services market. We are proud that over the past 10 years we have delivered such services for over 100,000 companies in Romania and in 2020 we will continue to provide our customers with the best solutions.

Moreover, in 2019 we made significant progress in our cost transformation and are extremely happy that our improvement efforts in costs and cash to fuel growth investments have started to pay off. The entire company has been going through a performance improvement program in this regard for over a year. For example, through smarter logistics and better inventory management, we were able to reduce our inventory by over 20 mil. EUR. Going forward we will continue to implement further relevant cost and cash improvements.

At the same time, we are investing in future capabilities. For example, we have improved our digitization by doubling our robotically automated processes to nearly 100 within 12 months and will continue to do so in 2020. We also started to implement Artificial intelligence and Machine Learning algorithms to help us become even more customized in our offerings. We will continue to invest in such future topics, for example we are discussing how to implement our “journey to cloud” added Nicolas Mahler.

“We will also continue to consistently invest in the improvement of our networks, technology and new ways to increase customer satisfaction through innovative offerings. We want to create offers that meet their needs and expectations at very attractive prices. For this, it is important that we continue to drive a strict focus on our cost discipline and our cash management.

Looking ahead, we have proven that our strategy and the transformation are working. We will continue to execute this in a rigorous manner. We have made very good progress already, now we need to focus on further improving our results. Especially our EBITDA margin will be a future focus, as the current level of slightly below 15% is not meeting our ambition. Midterm we have to reach a level of above 20% – and even this is low compared to other EU countries – to be able to finance our cyclical investment needs.

I am very confident that we will also be able to show year over year growth in the first quarter of 2020, if we continue on our path of strict customer focus and disciplined execution in our cost transformation. Our key to success will be to act reasonable, take bold decisions if needed and remain always customer oriented” concluded Nicolas Mahler.