The Romanian Association of Banks: 57% of the population is financially included and 87% of companies make payments via Internet/Mobile banking

Approximately 57% of the financially included population and 87% of companies make payments via Internet/Mobile banking, according to the market research

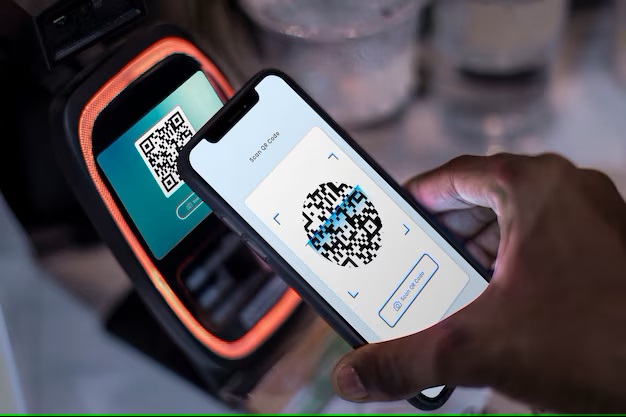

“The banking system in the perception of Romanians: lending and financial inclusion of Romanians”, carried out in 2024 by the Romanian Institute for Evaluation and Strategy (IRES) for the Romanian Association of Banks Electronic payments have increased rapidly, the share of the population making payments via Internet/Mobile banking registering an advance of 11 percentage points, compared to 2022.

The share of companies that use Mobile Banking applications on a daily basis it has almost doubled in the last two years, reaching 37% in 2024. In their regular transactions, individuals use card or card only 37% more, up 7 percentage points compared to 2022, 32% card and cash equally, 20% more cash and 11% Cash only.

At the national level, there are 21.7 million active cards. About 70% of individual respondents with bank accounts say they use debit cards, while credit cards are used by 25% of survey respondents. The degree of financial inclusion among adults in Romania has advanced to 71%.

Approximately 41% of companies do not pay employee salaries by card, slightly down from the level of 43% recorded in 2022. The degree of acceptance of card payments at the POS has reached 36% among companies. For collections, companies use 29% predominantly payment order, 24% all means of payment equally, 22% exclusively payment order, 11% predominantly cash, 5% predominantly card, 4% exclusively cash and 3% exclusively card.

88% of individual respondents and 91% of companies stated that they want to be informed about online fraud prevention methods. In the European month of cyber security, the Romanian Banks Association promotes awareness and offers banking service users recommendations on keeping their money safe online:

• Do not provide the bank card data under any circumstances: the number, the expiry date and the security code on the back of the three-digit card. This data is only used by the user for online payment on secure sites and not when you are connected to a public Wi-Fi network, it must be secured.

• Send the IBAN, not the card data, if you need to receive money;

• Never provide personal bank account usage data: username and access password;

• Banks will never ask for bank account passwords or bank card details. In the situation where these data were requested by phone, the recommendation is to end the call immediately.

• Do not trust the caller, check the authenticity of the message before taking any action. When you are not sure of the veracity of the message/phone call that seems to come from the bank or a public institution, you can validate by phone with the sender (including the bank) at a number that belongs to him and not one suggested by the caller;

• Beware of unrealistic investment promises! If it sounds too good to be true, it’s most likely a scam! Investments are not guaranteed. When you come across investment offers on the internet, avoid the trap of big short-term gains and do your due diligence!

• Criminals can use any pretext to take control of the bank account. Don’t install apps as investment-related.

• Do not enter the PIN code from the bank card on Internet sites and do not disclose it;

• To contact the bank immediately and notify the authorities if you have been the victim of fraud. The opinion survey was carried out in 2024 at the request of the Romanian Banks Association on a sample of 1,320 natural person respondents, of which 1,067 people use banking products, the maximum margin of error being +/-2.75% and among 500 companies