iO Partners: The lack of office space deliveries in Bucharest forces companies to plan future leasing contracts well in advance

The decrease in demand for office spaces in Bucharest following the pandemic period is reflected in the volume of pre-leases, which saw a reduction of over 50% between 2020 and 2023, according to an iO Partners study. Additionally, the low number of pre-leases is explained by the very few projects that are likely to be delivered in Bucharest in the next two years. This will be forcing companies to strategize their office space needs 2-3 years before their current contracts expire.

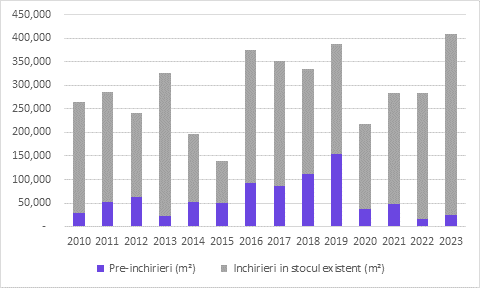

While during the 2010-2019 period, pre-leases accounted for an average of approximately 25% of the total demand for office spaces, or over 70,000 sqm per year, during the 2020-2023 period, the share of pre-leases dropped to less than half, averaging 11% of the total or about 30,000 sqm per year. This occurred despite annual deliveries of new office buildings remaining in the multi-annual average during 2020-2023, at nearly 160,000 sqm per year (compared to 156,000 sqm per year during 2010-2019).

The demand for office spaces in Bucharest decreased during the pandemic and subsequently due to many companies adjusting to a hybrid work regime, from both the office and home. Contributing factors included the energy crisis and high inflation, which increased the level of uncertainty faced by companies.

The historical low for pre-leases was reached in 2022, with just over 15,000 sqm, representing only 5.3% of the total demand. The situation did not change in 2023, with pre-leases totaling 23,600 sqm and accounting for 5.8% of the total demand.

Very few projects in Bucharest are expected to be delivered in the next two years: only 15,500 sqm in 2024 and 8,000 sqm in 2025. Developers have been discouraged from starting new projects due to limited demand, high construction costs, and the office space vacancy rate (14.3% at the end of 2023). On the other hand, developers who have projects ready and can deliver buildings starting in 2026 will be in an advantageous position.

“Considering that only two office buildings totaling approximately 24,000 sqm are expected to be delivered in Bucharest over the next two years, companies seeking office space should conduct an analysis and develop a strategy regarding future space needs well in advance, ideally 2-3 years before their current leases expire, not just a year earlier as was common practice before,” recommends Maria Florea, Head of Office Advisory at iO Partners.

Chart 1: Evolution of the share of pre-leases in total (gross) demand for office spaces in Bucharest

Source: iO Partners Research

About iO Partners:

iO Partners (IOP) is a real estate services company headquartered in Vienna, providing a full suite of services in the Czech Republic, Hungary, Romania, Serbia and Slovakia, comprising Agency, Leasing, Capital Markets, Valuation, Project and Development Services and Advisory. With a commanding presence in the Industrial and Office sectors, and the leading valuation team in the region, the company has offices in Belgrade, Bratislava, Bucharest, Budapest, Prague and Vienna. iO Partners is a JLL preferred partner in Czech Republic, Hungary, Romania and Slovakia.