Cushman & Wakefield Echinox: The first signs of a come-back for the office market: the pre-lease transactions increase and the renegotiations decrease

The volume of leasing transactions on the Bucharest office market increased in the first quarter of 2021 to 48,000 square meters, a 9% decrease from the similar period of the previous year, when the Covid-19 pandemic was still on its onset in Europe, reveals the research data of the real estate consulting company Cushman & Wakefield Echinox.

However, compared to the second half of 2020, when the market witnessed a low activity of leasing transactions, while the companies postponed as much as possible taking important decisions regarding their office location, which led to an annual 40% decrease of the transactional volume, the first signs of stability can now be observed, given a 29% share of renewal contracts compared to an annual average of 45% in 2020. Moreover, the share of pre-lease contracts increased from 20% to 46%, which shows that some companies have outlined their post-pandemic working policy and are now in a position to take decisions on the medium and long term.

In terms of deliveries, in the first quarter of 2020, there have been completed the Campus 6.2 buildings, part of the Campus 6 project developed by Skanska in the Politehnica area, and Millo Offices, a project developed by Forte Partners in the central area of Bucharest, the two buildings having a total area of almost 30,000 sqm. In comparison, in the first quarter of 2020, new office spaces with an area of 79,000 square meters were delivered in Bucharest. However, this year’s deliveries will be above the level of 2020, when 155,000 sqm projects have been completed, taking into account that by the end of this year another approximately 220,000 sqm of new modern office space are expected to be delivered.

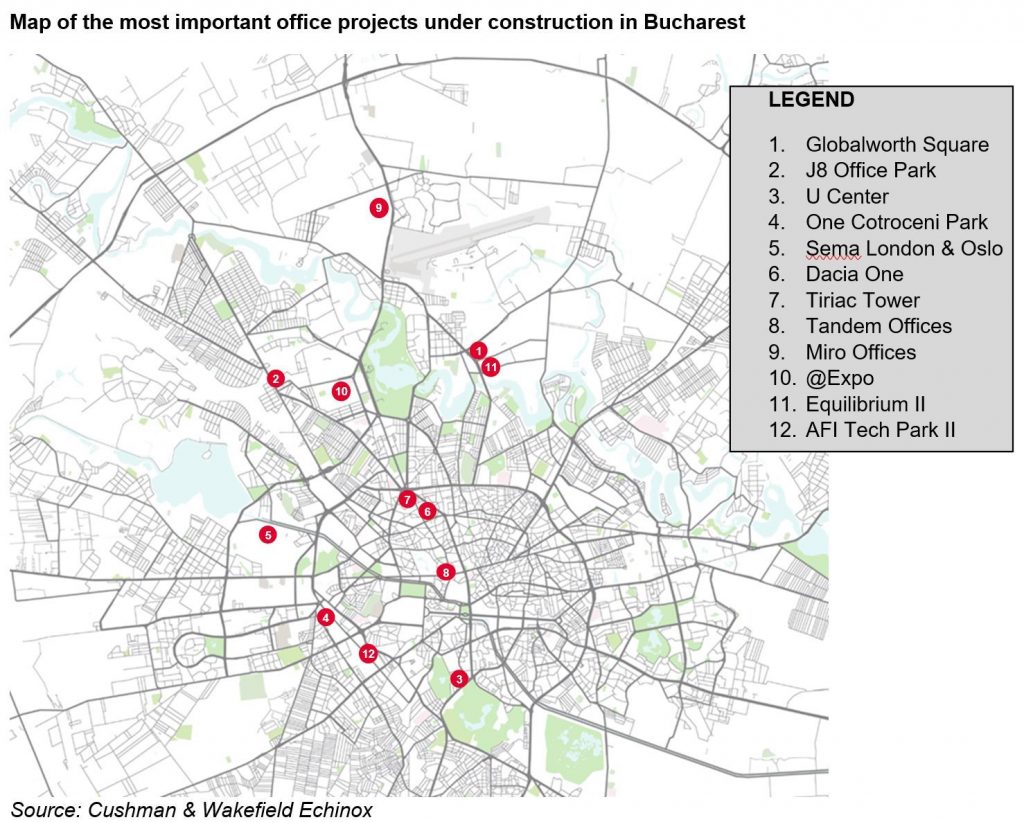

The (leasing) commercial stock of office buildings in Bucharest reaches about 2.98 million square meters, other buildings with an area of approximately 150,000 sqm being occupied by the landlords, while projects with a total area of 370,000 sqm are currently under construction, being scheduled for delivery between 2021-2023.

In this context, the vacancy rate (contractual) of the office spaces is 13.5%, noting a significant difference between class A (10.7%) and class B (22.1%) office spaces. Although we are witnessing the gradual employees’ return to offices, the use of spaces degree has currently remained at a relatively low level, of about 40-50%, given that most companies prefer to continue their Work from Home or hybrid systems.