SeedBlink’s Equity arm empowers EGV and their portfolio startups with efficient equity management tools

SeedBlink, the all-in-one equity management and investment company, announces a partnership with early-stage venture capital firm EGV – Early Game Ventures. As part of the collaboration, EGV will deploy the SeedBlink Equity product for its portfolio companies to streamline their equity management and elevate equity to a strategic asset.

With the recent announcement of Early Game Ventures Fund II, a new 60 million euro VC fund that will invest in early-stage startups in CEE, the partnership is very timely and aims to streamline and automate equity actions, from cap table management to investor reporting and governance, providing clarity and transparency for both startups and the investing fund.

Through a co-ownership structure between EGV and the invested startups, SeedBlink’s Equity platform acts as a single source of truth for all things equity, significantly reducing the time and effort required to track equity movements as well as recurring reporting.

For companies looking to build a culture of ownership with employee stock option plans, SeedBlink Equity fully supports their ESOP journey, from program setup to ongoing administration, dedicated employee portals, centralized documentation and update tracking.

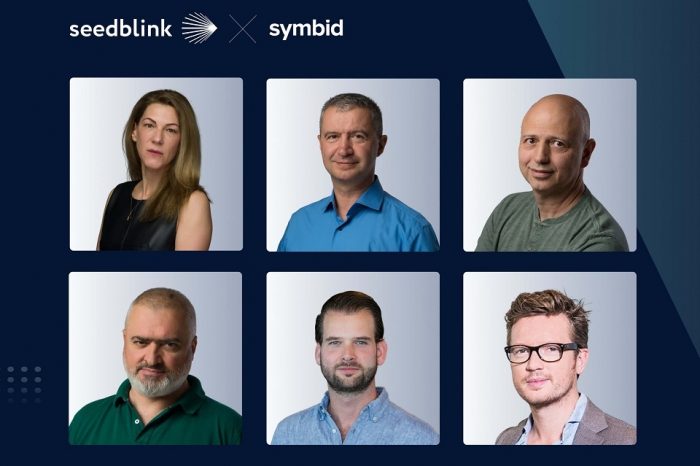

“By integrating cap table management, employee stock options, and investor communications, SeedBlink’s Equity management platform provides EGV’s startups with the tools they need to manage their equity efficiently and transparently. This increases their attractiveness to future investors and helps build a motivated team through clear and manageable equity incentives. For us, as a VC fund, it simplifies our governance and gives us complete visibility over the capitalization table and option pools of the portfolio companies,” declared Cristian Munteanu, Managing Partner, Early Game Ventures.

“We are delighted to partner with EGV, a flagship early-stage venture fund in CEE, to champion equity transparency and early-stage portfolio growth,” said Carmen Sebe, CEO of SeedBlink. “By providing clarity around equity management and a better understanding of the status quo as well as future scenarios, our solution benefits both the portfolio companies and VCs like EGV.”

Joining forces with VCs, lawyers, family offices, and angel networks, SeedBlink aims to nurture the growth of equity ownership in private European companies. This partnership represents a significant step forward in providing comprehensive equity management solutions, fostering growth and transparency in the early-stage startup ecosystem in CEE.

photo credits: Early Game Ventures