Mastercard, Digital Payments Index: The most important factor for stimulating the use of digital solutions is constant exposure to information and facilitating access to an everyday context in which it can be applied

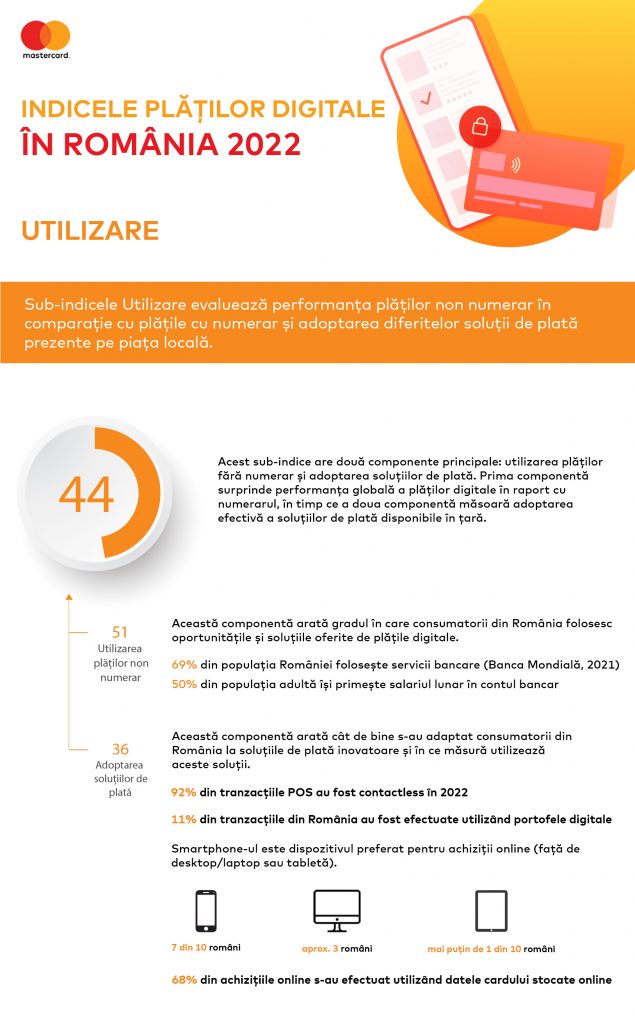

The level of use of digital payments in Romania stands at 44 points out of 100, according to the Digital Payments Index, a report developed by Mastercard, which analyzes the evolution of digital payments at the national level.

“Cards have started to take market share from cash payments and with a wider user base, the direction for overall market behavior is also taking shape. However, progress is slow and sustained efforts are needed for Romanians to prefer digital methods to cash payments. Providing the necessary acceptance and payment infrastructure is a prerequisite, but the main factor in encouraging the use of digital solutions is ensuring a continuous flow of information. The more people know about digital payment solutions, the more secure they will feel and then decide to use them – and once they are convinced of the advantages, they will make it a natural gesture , daily”, said Cosmin Vladimirescu, General Manager Mastercard Romania and Croatia.

The Use sub-index tracks two components: the use of cashless payments and the rate of adoption of payment solutions, each with an equal weight in the final score.

Use of cashless payments

The Use of Cashless Payments component analyzes the overall performance of digital payments, compared to cash, and scored 51 points out of 100. The result is supported by the most recent data available for Romania, which shows that although the proportion of the banked population was 69%, not everyone capitalizes on the opportunities, innovations and new solutions offered on the market. The factors are multiple and include the perception of the safety of using digital payment methods, the fact that some merchants still do not accept card payments and the preference of many employers to pay wages in cash. Half of employees receive their wages in cash, which also increases the chances that they will use cash mostly for purchases and payments.

The percentage is basically unchanged from 2021, despite a 9-point increase in the banked population, from 60% to 69%. It is expected that with the increase in the number of consumers who collect their salary or income in the account, the use of digital payment solutions for shopping in physical or online stores, paying utility bills or other types of everyday payments for which cash is still preferred will also increase.

Rate of adoption of payment solutions

The Payment Solutions Adoption Rate component shows how well consumers in Romania have adapted to innovative payment solutions and to what extent they use these solutions. In 2022, it scored 36 points out of 100, a result indicating that some of the existing infrastructure is still underutilized. Contactless solutions, both ATM and POS, are increasingly popular due to their simplicity and efficiency.

The rate of use of contactless ATMs increased by 2 points, up to 4%, reflecting infrastructure limitations, as the proportion of contactless ATMs in total ATMs is low in Romania. On the other hand, contactless payments at POS dominate the market: 92% of POS transactions were contactless in 2022, up from 2021. In 2022, 11% of transactions in Romania were made using digital wallets, an increase of 4 points compared to 2021. The result reflects a greater openness on the part of consumers, as more issuers offer Apple Pay and Google Pay or create their own own wallets.

The number of electronic transactions with voucher-type cards registered in Romania in 2022 was five times higher than in 2020. This increase was determined by the acceleration of electronic payments during the pandemic and the increase in the percentage of adoption of digital payment methods, including vouchers issued electronically (meal vouchers, gift vouchers, holiday vouchers, cultural vouchers, social vouchers). Among the devices preferred by Romanians to make online purchases, the smartphone remains in first place.

In 2022, more than 7 out of 10 Romanians used a mobile phone to pay online compared to a desktop computer (about 3) or a tablet (less than 1 out of 10). In 2022, card data was stored online for 68% of online purchases, while in 2021 the level was 62%, thus resulting in an upward trend by increasing by almost 10%.

About the Digital Payments Index

The Digital Payment Index (DPI) is an analysis tool that tracks the evolution of digital payments at the national level. The index was carried out this year in four countries: Austria, Croatia, Romania and Hungary, analyzing the data recorded at the level of 2022. Romania obtained a score of 56 out of 100 points, a result calculated based on the individual scores of the three sub-indices : 70 for Infrastructure, 55 for Knowledge and 44 for Usage.

photo credit: Mastercard