Boston Consulting Group: What can we expect in 2021? Romanian economy to date shows a mixed picture

In the fight with the COVID-10 pandemic, there is some light at the end of the tunnel: several vaccines have already been approved and started to be deployed, while others are in final approval phases. Though, the road ahead remains bumpy, and questions to be addressed to in the next period include:

- How effective will vaccines deployment at scale be?

- What will be the willingness of the population to undertake vaccination?

- How efficient will the healthcare administration measures be along the way?

The response to these questions can have a significant impact on the pandemics’ slowdown: optimistically we could see it winding down in the second half of 2021, pessimistically in the second half of 2022.

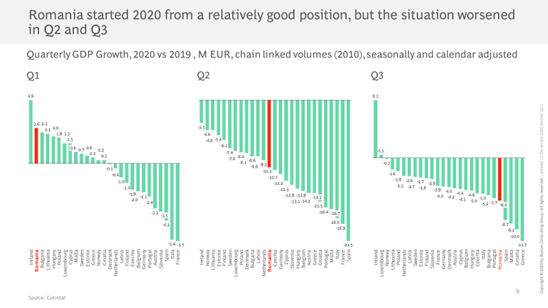

In this context, the Romanian economy to date shows a mixed picture: after a relatively good performance right before the crisis (second largest growth in Europe in Q1 2020), Q2 GDP decline was close to the EU average but in Q3 2020 GDP decline was among the highest 5 in Europe.

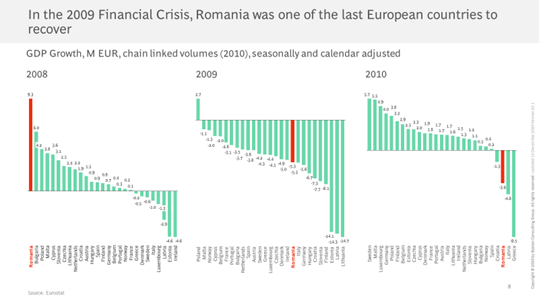

If we compare to the 2009 Financial Crisis, Romania started from the highest GDP growth in Europe in 2009, but saw a huge drop in 2009, when GDP decline was close to EU average, and was among the 3 worst performers in 2010, when Romanian GDP continued to decline while most EU countries had returned to growth. Overall, there is a time lag in the economic results of Romania:

- On the one hand, Romania is more dependent on other EU countries and is positioned in the lower part of the value chain, therefore economic waves hit us later;

- On the other hand, reactions tend to be delayed (at all levels) thus the impact is consequently seen later.

There are many uncertainties in 2021, but in order to be successful in 2021 Romanian companies should follow several simple rules: 1. be proactive, 2. stick to a clear vision, 3. increase demand vitality, 4. become more agile and 5. build enterprise resilience.

COVID-19 recovery is impacted by government policies, business and public responses; though, first and foremost the complete return to full economic activity can only be achieved when the pandemic gets under control.

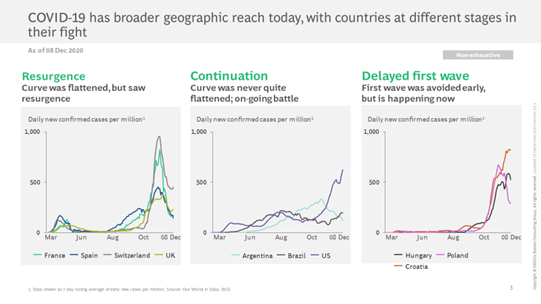

As of today, most countries are still fighting the virus.

Infections spread had flattened in countries like France, Spain, Switzerland and UK, but are now seeing a strong resurgence. In other countries, US, Argentina and Brazil included, infections curve never really flattened, and the battle is still ongoing. Romania, like other SEE countries, Poland and Hungary included, sees a delayed first phase: after a minimal hit in the first wave, it hit back with strong intensity in a delayed first wave.

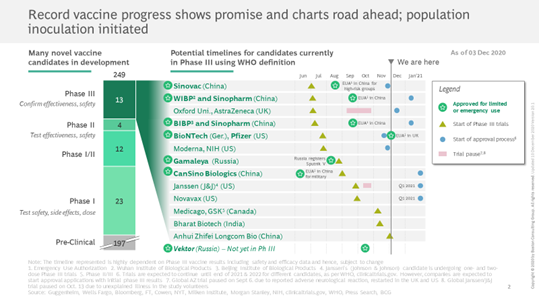

A big hope for curving the pandemic is vaccines: 13 of them are in the final phases of development, while some of them have been approved and started to be deployed in several countries.

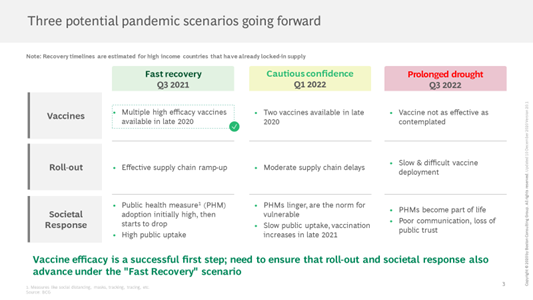

Yet, vaccines deployment will take time and we need to ensure that roll-out and societal response also advance in order to get to a fast recovery scenario, in which visible results can be expected staring Q3 of 2021.

Defeating pandemic by Q3 2021 will require balancing multiple interventions across 3 Acts:

- Act I – Mastering “epinomics”: As cases surge, we must swiftly take the right set of “epinomic” actions to drive highest reduction in virus reproduction at the lowest socioeconomic cost, and maintain vigilance until virus monitoring or vaccines are at scale;

- Act II – Scaling the virus monitoring system: We must build robust and scaled virus monitoring systems (testing, tracking, tracing, and quarantining) to contain the virus until we reach herd immunity or vaccine supply is sufficient;

- Act III – Perfecting the vaccine roll-out: Need to scale vaccines through to herd immunity, which will require a flawless roll-out and clear, transparent communications that drive uptake.

Without a successful balance of these measures, recovery can be pushed to 2022 – even late 2022 in a pessimistic case.

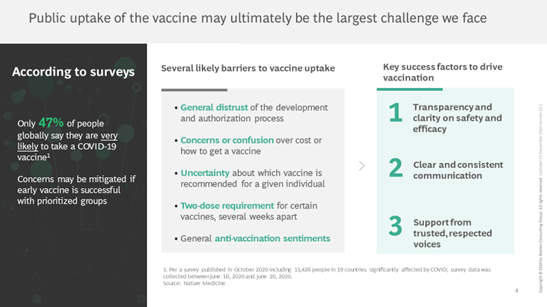

One of the biggest challenge we face is the public update of the vaccine: only 47% of people globally say they are very likely to take a COVID-19 vaccine. Concerns include:

- General distrust of the development and authorization process;

- Confusion over costs or modalities to get a vaccine;

- Uncertainty about which vaccine is recommended for a given individual

- Vaccination process, with its two-dose requirement for certain vaccines, several weeks apart;

- General anti-vaccination sentiments.

While concerns may be mitigated if early vaccine is successful with prioritized groups, uncertainties remain.

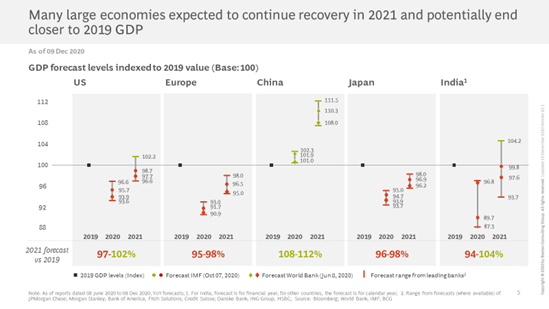

In this context, while there were several positive economic signs in the past few months, revolving uncertainties related to the healthcare situation continue to challenge economic forecasts. Based on the last estimates, with the exception of China, all other regions are not expected to firmly return to 2019 economic levels in 2021: full recovery to pre-crisis levels is expected in 2022.

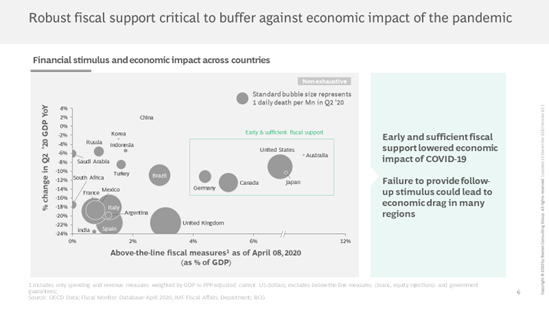

The huge amount of support given by several countries yielded results: Germany, US, Canada, Japan and Australia are good examples of countries where stimulus helped minimize GDP impact, though countries like China and Korea managed to contain their GDP impact with limited support but a very good control of the healthcare crisis.

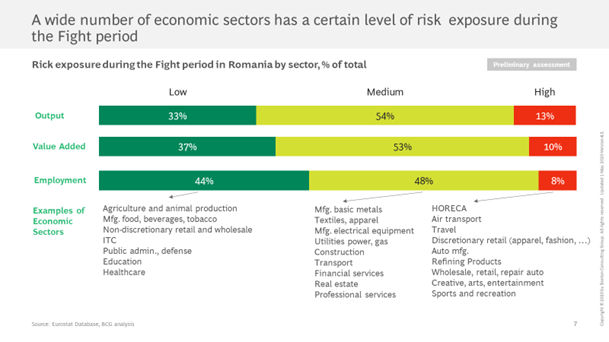

Failure to provide follow-up stimulus could lead to economic drag in certain regions. In the case of Romania, the huge pressure on the budget deficit raises significant questions on the capacity to further support the economy. The end of the loan moratorium can generate headaches for the financial sector, while SMEs in general and highly affected sectors in particular could continue to struggle in 2021. Sectors totaling 50-60% of the economic output, value-added and employment are impacted, of which approximately 20% are quite heavily affected by the COVID-19 crisis.

There are several sectors that fared relatively well the crisis:

- IT, which has been growing in Romania since several years, and for which the digitization that was pushed heavily by COVID-19 had a positive influence globally;

- Manufacturing and retail of non-discretionary items, stimulated by the changing consumption trends driven by social distancing measures (and the inherently increased time spent at home), but also of certain house improvement or technology items;

- Healthcare and pharma, driven by the increased care we have to put on health but also by other factors like numerous tests that the population had to make;

- Agriculture, which had a very difficult year in 2020, can see a rebound in 2021.

Public investments, including in the struggling areas of infrastructure, education and health, and a big hope, together with the absorption of the higher allocation of EU funds, both in the public and private sector. These could also help the economy, but we must challenge Romania’s bad history of dismal public investments and of limited EU funds absorption.

Moreover, we need to learn from the lessons of the past. In the 2009 Financial Crisis, Romania started from the highest GDP growth in Europe in 2008, had a huge drop in 2009 with a decline close to EU average, and was among the 3 worst performers in 2010 with a material economic decline while most EU countries had already returned to growth.

Overall, there seems to be a large inertia, a time lag in the economic reaction of Romania, which could be explained by 2 facts:

- Romania is more dependent on other EU countries and is positioned lower in the value chain, therefore economic waves hit us later;

- In Romania, public and business reactions tend to be delayed (at all levels) thus results come later.

As we look at the GDP progression in 2020, we see a mixed picture: after a relatively good performance right before the crisis (second largest growth in Europe in Q1), Q2 GDP decline was close to the EU average while in Q3, GDP decline was among the highest 5 in Europe.

Therefore, is we want to fare successfully through the uncertainties of 2021, Romanian companies should follow several simple rules:

- Be proactive: Time is money, therefore act quickly to get cash and costs out quickly to protect and create a strong foundation that will allow you to gain advantage and to start investing (potentially through M&A), growing faster than the competition.

- Stick to a clear vision: Even as you look for new sources of growth, top performers should pursue a clear vision and a reasonably small number of long-term themes; do not spread yourselves too thin.

- Increase demand vitality: As we move from a push to a pull market, you need to create demand-focused capabilities, to adapt commercial efforts to what the customers need now; step change online presence and go-to-market ability, shift to online selling and servicing.

- Become more agile: Given variability and uncertainty, build agility and adaptation into your supply base and supply chain

- Build enterprise resilience: Built organizations that can withstand future shocks, but also anticipate them, including streamlining core operations and redesigning processes to capitalize on digital capabilities.